What we do

Modern Wealth

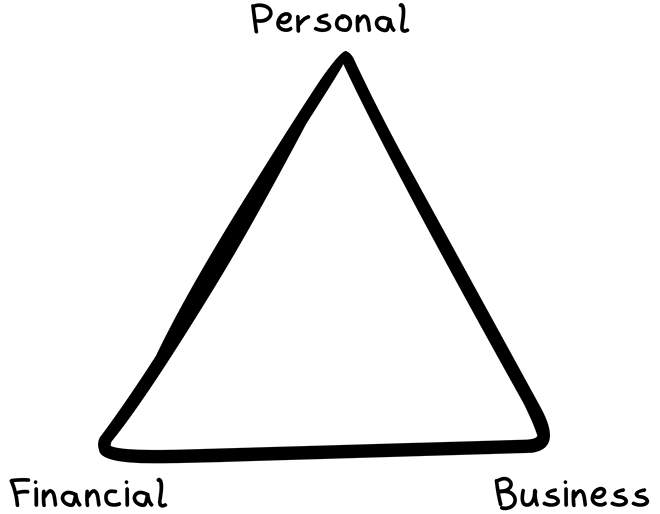

At Modern Wealth, we believe in challenging the status quo of traditional Financial Planning, advising differently, and designing our clients' best life. We do this by integrating Financial Planning, Value Acceleration Methodology™, and Life Planning into a seamless process called EVOKE®. We are an independent fiduciary that provides fee-only Financial Planning and Business Advisory tailored to Entrepreneurs and Small Business Owners.

Learn MoreOUR SERVICES

EVOKE® Financial Planning and Business Advisory

Quoted In