Cash Flow Planning

Cash Flow Maps

At Modern Wealth, we’ve transformed the complex world of cash flow analysis with our innovative Cash Flow Maps. These maps offer a visual journey through your financial landscape, allowing you to select and view specific years with ease. Our intuitive timeline slider and tooltips guide you through key financial events, especially during retirement, making it simple to track your financial milestones.

Our Waterfall Chart provides a clear, Sankey-style visual representation of your financial inflows and outflows. It’s designed to give you an immediate understanding of the weight of each transaction, aligning perfectly with our detailed cash flow summaries for a cohesive financial picture.

For a more detailed analysis, our Breakdown Chart categorizes your cash movements, giving you the power to explore each category in depth. This granular view aligns with the summary data, offering a comprehensive look at your financial activities and empowering you with the knowledge to make informed decisions about your financial future. With Modern Wealth, navigating your financial flows becomes a straightforward and enlightening experience.

Cash Flow Summary

Modern Wealth’s Cash Flow Summary service offers a streamlined and comprehensive view of your financial activities throughout the year. It’s designed to meticulously track every dollar earned and spent, breaking down your financial data into eight clear categories: Income Inflows, Planned Distribution, Other Inflows, Total Inflows, Expenses & Goals, Tax Payment & Planned Savings, Total Outflows, and Net Flows. This categorization simplifies the understanding of your cash flow, from income sources like salary and business income to expenses, savings, and taxes.

Our service excels in providing a detailed breakdown that not only tracks financial movements but also aids in financial planning and strategy. By categorizing inflows from various sources such as salaries, business earnings, asset sales, and insurance proceeds, alongside outflows for expenses, goals, and savings, we offer a clear picture of your financial health. The Net Flows category is particularly insightful, revealing the balance after expenses, which indicates your savings or expenditures over the year.

The Cash Flow Summary is more than just a tracking tool; it’s a strategic asset that provides valuable insights to optimize your financial strategy. With this service, you’ll gain a thorough understanding of your total cash flow situation, empowering you to make informed decisions and ensure financial well-being. Whether you’re planning for retirement, managing business finances, or setting personal financial goals, Modern Wealth’s Cash Flow Summary is an indispensable resource for staying informed and in control of your finances.

Income Inflows

Modern Wealth streamlines your financial overview by categorizing income into distinct segments, ensuring clarity and ease of understanding. We cover all bases, from salary and self-employment to Social Security and pensions, as well as annuities, investment returns, business distributions, trust income, and other miscellaneous sources. This comprehensive breakdown allows you to see the full spectrum of your income streams in one glance.

Our service simplifies the complexity of financial planning by providing a clear picture of your income inflows. Whether it’s regular earnings, retirement benefits, or unexpected gains, we ensure that every aspect of your income is accounted for and easily accessible for analysis and decision-making.

With Modern Wealth, you gain a partner that not only simplifies your financial data but also empowers you with the knowledge to make informed financial choices. Our platform’s detailed yet user-friendly approach provides a complete overview of your income, facilitating effective financial planning and strategy development.

Other Income Sources

At Modern Wealth, we recognize the dynamic nature of life and the importance of adapting to changes. Our services are designed to help you track and manage a variety of income sources beyond your regular earnings. This includes rental income, profits from real estate sales, business asset liquidation, and lifestyle asset sales. We also account for income from stock options, RSUs, inheritances, insurance benefits, and long-term care insurance payouts.

Our comprehensive approach ensures that you have a clear understanding of your financial picture, including all forms of income. Whether it’s a steady stream from rental properties or a one-time windfall from an inheritance, we help you integrate these into your overall financial plan. Our goal is to provide you with a complete view of your income streams, making financial planning and wealth management both straightforward and effective.

By summarizing all additional income sources into the Total Other Inflows, we offer a holistic view of your finances. Our user-friendly tools and expert guidance simplify the financial planning process, enabling you to make informed decisions and effectively manage your wealth, no matter how your life and income evolve.

Equity Compensation

We offer a strategic approach to equity compensation management, designed to simplify and enhance your financial planning. Our service consolidates your equity grants into a single, detailed table, providing a clear view of grant specifics and financial values. We perform a comparative analysis of your current and proposed stock strategies, visualizing assets, taxes, and cash flows to optimize your financial outcomes.

We delve into the details of your stock plan, offering a granular cash flow analysis for both existing and future grants, and develop a customized strategy that includes exercises and liquidation plans. This tailored approach is integrated into your retirement planning, ensuring a cohesive financial strategy.

Our goal is to demystify the complexities of equity compensation, offering clear insights and personalized strategies. We’re dedicated to partnering with you to achieve financial clarity and success, making the most of your equity compensation benefits as part of your overall financial plan.

Expenses

At Modern Wealth, we simplify your financial management by providing a detailed breakdown of expenses, ensuring you have a comprehensive understanding of where your money is allocated. Our service categorizes expenses into living costs, housing, debt, healthcare, insurance premiums, and costs associated with rental or vacation properties. We also account for miscellaneous expenses, offering a complete view of your financial outgoings to aid in informed decision-making.

Our approach to expense management is designed to streamline your financial tracking, capturing pre-retirement and retirement living expenses, and categorizing costs to provide clarity. This allows for effective financial planning, helping you manage your finances before and after retirement, and ensuring that you are prepared for all stages of life.

By offering a clear picture of your financial landscape, Modern Wealth empowers you with the knowledge to make strategic financial decisions. Our goal is to simplify the complexities of financial management, providing you with insights and tools to enhance your financial planning and secure your financial future.

Goals

At Modern Wealth, we understand that planning for life’s significant milestones is crucial. Our unique EVOKE® process and the insightful “Three Questions” enable us to grasp what truly matters to you, allowing us to tailor your financial plan to your most cherished life goals. Whether it’s funding education, purchasing a vehicle, planning the perfect wedding, or leaving a legacy, we quantify these aspirations in the Cash Flow Goals section for a clear financial path.

Our approach ensures that each goal is not just a dream but a planned financial target. We provide a comprehensive overview of your ambitions through the Total Goals summary, integrating all your identified objectives into one clear financial strategy. This methodical approach simplifies the complexity of financial planning, giving you a transparent and manageable roadmap to your aspirations.

Empowering you with clarity and control over your financial journey is our mission. By simplifying the goal-setting and tracking process, we help you navigate the financial aspects of your life’s most important events with confidence and ease, ensuring that you’re well-prepared to achieve each milestone on your path to living your best life.

Taxes

We offer a detailed tax projection service to streamline your financial planning. We cover all bases, providing projections for federal, state, and local taxes, as well as FICA contributions for Social Security and Medicare. This comprehensive analysis helps you understand your tax obligations based on your residency and other relevant factors.

Our goal is to simplify tax planning for you. By breaking down each tax category, we offer a clear picture of your potential liabilities, allowing you to make informed financial decisions. The total tax projection consolidates these figures, giving you a complete overview of your tax responsibilities.

With Modern Wealth, tax planning becomes less daunting. We provide the insights you need to navigate your finances effectively, ensuring that you’re well-prepared for tax season and beyond. Our service is designed to demystify the complexities of taxes, empowering you with the knowledge to optimize your financial strategies.

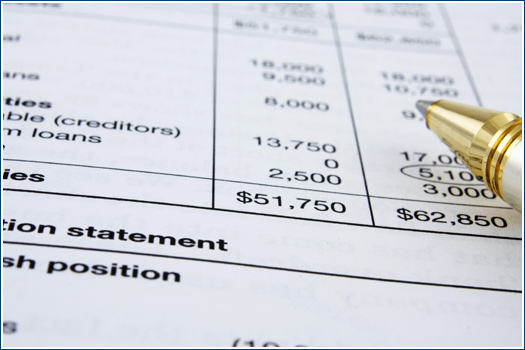

Net Worth

At Modern Wealth, we provide a detailed analysis of your net worth, offering a snapshot of your financial standing by categorizing your assets and liabilities. Our breakdown includes taxable and tax-advantaged investments, vested options, real estate values, business and trust assets, as well as any outstanding debts, including mortgages and loans. This allows for a clear and comprehensive view of your financial health.

Our net worth calculation method is straightforward: we sum up all your assets and subtract your liabilities to reveal your true financial position. This calculation is crucial for effective wealth management, as it helps identify areas of strength and opportunities for growth within your portfolio.

By partnering with Modern Wealth, you gain a clear understanding of your financial landscape, empowering you to make informed decisions for your future. Our structured financial overview is designed to provide clarity and insight, guiding you towards financial success and stability.

Exploration Call

Join us for a complimentary 30-minute chat focused on your needs, goals, and vision. Enjoy a relaxed, no-pressure session to learn about our process and ask any questions. We’re here to listen, not to sell. Let’s discover what’s possible together!